AMADEUS AUTOMATED REFUNDS

Amadeus automated refunds allow you to refund sale documents and electronic tickets quickly and easily for tickets issued on 364days in the past.The refund transactions you enter a search for data stored in the central ticketing server's document database. If the data is still available, the system uses it to create a refund record. Data is normally stored in the system for 180 days. If the data is no longer available, you enter details of the refund manually into a blank refund record.

You can process refund records directly for full refunds, or manually update them for partial refunds.

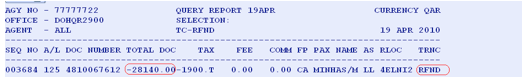

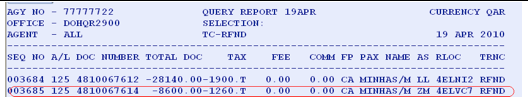

Here is an example of a query report that contains refunded documents. They are indicated by the 'RFND' transaction type code in the last column.

FEATURES

EXPLANATION

- Automatic Population of a refund record using stored ticket data

- Interactive Automated refund of Electronic tickets

- Automated refund of paper tickets.

- Full and Partial refund capability

- Increased efficiency

- Increased productivity

- Increased flexibility

EXPLANATION

- Ticket issued on 364days in the past.

- You can process two types of refunds

- FULL - To refund all coupons of the ticket

- PARTIAL- To refund only some coupons of the ticket

- You can refund e-ticket coupons that have an ‘’OPEN: O’’ status. Status indicators are received from the airline along with Electronic Ticket Settlement Authorization Code (ESAC). Both the status indicator and ESAC are used by the system to create the refund record.

- Refunded coupons are indicated as ‘’REFUNDED: R’’ in the e-ticket record and in the Airline system where the e-ticket record is stored.

- The Automate refund can be used in three different ways. You can generate an automated refund by :

- TICKET NUMBER

- FA or FHE element from PNR

- Sequence number from the Query Report (TJQ Display)

REFUND RECORD UPDATION CRYPTIC ENTRIES

The refund transactions you enter a search for data stored in the central ticketing server's document database. If the data is still available, the system uses it to create a refund record. Data is normally stored in the system for 180 days. If the data is no longer available, you enter details of the refund manually into a blank refund record. You can process refund records directly for full refunds, or manually update them for partial refunds. Following cryptic entries are to update a refund record.- PASSENGER NAME TRFU/NM MINHAS MUHAMMAD ZAFAR MR

- DATE OF ISSUE /I 25JAN02

- ADD DOC NUMBERS /DA 2

- DELETE DOC NUMBERS /DX 2

- CHECK DIGIT /D 1 DG 2

- ADD TKT/DOC COUPONS /D 1 C34 /D 2 C12

- DELETE TKT/DOC CPNS /DX 1 C34 /DX 2 C12

- DOCUMENT TYPE /TKT Y

- ITINERARY /S D

- FARE PAID /F 1000.00

- FARE PAID IN ALTERNATE

CURRENCY /F NZD100000

- FARE USED /U 500.00

- COMMISSION /FM 9

/FM 9N

/FM 100.00A

- CANCELLATION PENALTY /CP 50.00A

/CP 50

- CANCELLATION PENALTY /CM 9 COMMISSION /CM 100.00A

- MISCELLANEOUS FEE /MF 10

- ADD SPECIFIC TAX /TA10.00GB

/TA10.00ZPMIA2

/TA10.00XFJFK4.5

- UPDATE EXISTING TAX /TU4-10.00

- DELETE SPECIFIC TAX /TX 9

/TX 1-12

- TOUR CODE /TC NRD09900

- NET REFUND /NF 10000.00

- FORM OF PAYMENT /FP 1 CASH

/FP 2 CCVI111100002222...

- FOP AMOUNT /FP A 1 1000.00

- CUSTOMER FILE REF /CD 1 DATA

- ORIGINAL ISSUE /FO 1253700000007LON...

- REMARKS /RM FREEFLOW

- AIRLINE AUTHORITY /AA 10504Q59QBXE9C

- ORIGINAL ISSUE /FO 1253700000007LON...

- REMARKS /RM FREEFLOW

- AIRLINE AUTHORITY /AA 10504Q59QBXE9C

- FARE USED /U 500.00

- COMMISSION /FM 9

/FM 9N

/FM 100.00A

- CANCELLATION PENALTY /CP 50.00A

/CP 50

- CANCELLATION PENALTY /CM 9 COMMISSION /CM 100.00A

- MISCELLANEOUS FEE /MF 10

- ADD SPECIFIC TAX /TA10.00GB

/TA10.00ZPMIA2

/TA10.00XFJFK4.5

- UPDATE EXISTING TAX /TU4-10.00

- DELETE SPECIFIC TAX /TX 9

/TX 1-12

- TOUR CODE /TC NRD09900

- NET REFUND /NF 10000.00

- FORM OF PAYMENT /FP 1 CASH

/FP 2 CCVI111100002222...

- FOP AMOUNT /FP A 1 1000.00

- CUSTOMER FILE REF /CD 1 DATA

- ORIGINAL ISSUE /FO 1253700000007LON...

- REMARKS /RM FREEFLOW

- AIRLINE AUTHORITY /AA 10504Q59QBXE9C

- ORIGINAL ISSUE /FO 1253700000007LON...

- REMARKS /RM FREEFLOW

- AIRLINE AUTHORITY /AA 10504Q59QBXE9C

REFUND RECORD MANUAL UPDATE ENTRIES

Following are the cryptic entries to update the refund records:

PASSENGER NAME

This field contains the passenger name and the title printed on the document you are refunding. To update this field, enter: TRFU/NMMINHAS ZAFAR MR

This field contains the passenger name and the title printed on the document you are refunding. To update this field, enter: TRFU/NMMINHAS ZAFAR MR

DATE OF ISSUE

This field contains the date on which the document you are refunding was originally issued. To update this field, enter: TRFU/I25NOV09

This field contains the date on which the document you are refunding was originally issued. To update this field, enter: TRFU/I25NOV09

/I 25NOV09 Slash, Issue Date Identifier Date of Issue

ADD DOCUMENT RANGE

This field contains the ticket/document number or number range of the documents you are refunding. To add two conjunction tickets, for example, enter: TRFU/DA2

/DA 2 Slash, Document range identifier Number of consecutive document numbers to add

System Response

This field contains the ticket/document number or number range of the documents you are refunding. To add two conjunction tickets, for example, enter: TRFU/DA2

/DA 2 Slash, Document range identifier Number of consecutive document numbers to add

System Response

DELETE DOCUMENT RANGE

To delete the document numbers from the existing number range, enter: TRFU/DX2

/DX 2 Slash, Delete range Identifier Number of consecutive document numbers to delete

System Response

To delete the document numbers from the existing number range, enter: TRFU/DX2

/DX 2 Slash, Delete range Identifier Number of consecutive document numbers to delete

System Response

ADD CHECK DIGIT

To add check digit, enter TRFU/D1DG6

/D Slash, Document Field Identifier

To add check digit, enter TRFU/D1DG6

/D Slash, Document Field Identifier

1 Number of the document to which check digit applies

DG Check digit Identifier

ADD DOCUMENT COUPONS

This field contains the unused coupons of the document you are refunding. To add coupons, enter: TRFU/D1C34/D2C12

This field contains the unused coupons of the document you are refunding. To add coupons, enter: TRFU/D1C34/D2C12

/D1 Slash, Document Number 1 field identifier

C34 Coupon number 3 and 4

/D2 Slash, Document Number 2 field identifier

C12 Coupon number 1 and 2

System Response

System Response

DELETE DOCUMENT COUPONS

To delete the existing coupon, enter: TRFU/DX1C12/DX2C34

To delete the existing coupon, enter: TRFU/DX1C12/DX2C34

/DX Slash, Delete document identifier

1 Document number 1

C12 Coupon 1 and 2 (Used coupons to delete)

/DX Slash, Delete document identifier

2 Document number 2

DOCUMENT TYPE

The document type field identifies whether or not there is a document coupon to refund. For documents to be refunded, this field must be set to y for yes. When this field is set to Y, it is mandatory to have a value in the coupons field.

The document type field identifies whether or not there is a document coupon to refund. For documents to be refunded, this field must be set to y for yes. When this field is set to Y, it is mandatory to have a value in the coupons field.

If there is no document coupon available for refund, for example in specific cases of denied boarding or downgrading, this field can be set to n for no and the coupons field to 0000. To update this field, enter: TRFU/TKTY

/TK Slash, Document type field identifier

TY Y (Yes), N (No)

System Response

System Response

ITINERARY TYPE

This field identifies the type of sale (Domestic or International) of the document you are refunding. To update this field, enter: TRFU/SI

/S Slash, Type of sale field identifier

I I (International), D (Domestic)

System Response

FARE PAID

This field contains the original fare paid (excluding taxes) of the document you are refunding. To update this field, enter: TRFU/F1500

This field contains the original fare paid (excluding taxes) of the document you are refunding. To update this field, enter: TRFU/F1500

/F Slash, Fare paid field Identifier

1500 Fare Paid Amount (1 – 11 characters)

System Response

System Response

FARE USED

This field contains the fare that applies to the coupons of the document that have already been used. To update this field, enter: TRFU/U650

/U Slash, Used Fare field Identifier

650 Used Fare Amount (QAR 650.00)

System Response:

System Response:

COMMISSION

This field contains the commission that applies to the original sale of the document you are refunding. To update this field, you can make the following entries:

This field contains the commission that applies to the original sale of the document you are refunding. To update this field, you can make the following entries:

- TRFU/FM7

- TRFU/FM7N

- TRFU/FM100.00A

/FM Slash, Commission Field Identifier

7 Percentage Value for commission

7N Percentage, Calculated on Net Fare

100.00A Fixed Amount as commission

System Response:

CANCELLATION PENALTY

This field contains the cancellation penalty that applies to the refund. To update this field, you can make the following entries:

This field contains the cancellation penalty that applies to the refund. To update this field, you can make the following entries:

- TRFU/CP100

- TRFU/CP100A

/CP Slash, Cancellation Penalty field identifier

100 Percentage (100%)

Note: If you don’t enter the Amount indicator (A) in your entry, the system defaults to percentage.

CANCELLATION PENALTY COMMISSION

This field contains the commission that applies to the cancellation penalty charged for the refund. To update this field, you can make the following entries:

- TRFU/CM7

- TRFU/CM100A

/CM Slash, Commission applies on penalty field identifier

7 Percentage (7%)

100A Amount (QAR100.00)

MISCELLANEOUS FEE

In this field, you can enter an amount for administrative charges related to the refund. To update this field, enter: TRFU/MF100.00

In this field, you can enter an amount for administrative charges related to the refund. To update this field, enter: TRFU/MF100.00

/MF Slash, Miscellaneous Fee field Identifier

100.00 Amount (QAR100.00)

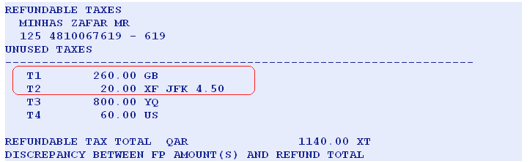

ADD TAX FOR REFUND

This is the sum of the unused refundable taxes in the refundable tax record. You can add, update and delete individual taxes in the refundable tax record.

ADD TAX FOR REFUND

This is the sum of the unused refundable taxes in the refundable tax record. You can add, update and delete individual taxes in the refundable tax record.

To display the tax record from the refund record, enter: TRFT

To add an individual unused tax, enter one of the following:

To add an individual unused tax, enter one of the following:

- TRFU/TA260.00GB

- TRFU/TA20.00XFJFK4.50

260.00 Tax Amount

GB Tax code

20.00 Tax Amount

XF Tax Code

JFK4.50 Airport/Segment Tax Breakdown (Three Alpha and 1-5 Characters including decimal placement)

System Response:

System Response:

UPDATE EXISTING TAX

To update the existing tax amount, enter: TRFU/TU1-180.00

/TU Slash, Tax update field identifier

To update the existing tax amount, enter: TRFU/TU1-180.00

/TU Slash, Tax update field identifier

1 Tax number 1

- Dash

DELETE TAX

To delete the individual tax, enter: TRFU/TX4

/TX Slash, Delete tax field identifier

/TX Slash, Delete tax field identifier

TOUR CODE

This field contains the fare discount code/tour code that applies to the document you are refunding. To update this field, enter: TRFU/TCNRD00500

/TC Slash, Tour code Field Identifier

This field contains the fare discount code/tour code that applies to the document you are refunding. To update this field, enter: TRFU/TCNRD00500

/TC Slash, Tour code Field Identifier

NRD00500 Tour code

System Response:

System Response:

NET REFUND

This field is used for net remit tickets. It contains the net fare amount to be refunded. The net refund must be equal to or less than the fare paid value. To update this field, enter: TRFU/NF850.00

/NF Slash, Net refund field identifier

This field is used for net remit tickets. It contains the net fare amount to be refunded. The net refund must be equal to or less than the fare paid value. To update this field, enter: TRFU/NF850.00

/NF Slash, Net refund field identifier

850.00 Net Refund Amount (QAR850.00)

System Response:

System Response:

FORM OF PAYMENT

This field contains the form or forms of payment for the document you are refunding and for the refund. You can enter up to three different forms of payment.

To update this field, enter, for example: TRFU/FP1CASH

/FP Slash, Form of payment Field Identifier

This field contains the form or forms of payment for the document you are refunding and for the refund. You can enter up to three different forms of payment.

To update this field, enter, for example: TRFU/FP1CASH

/FP Slash, Form of payment Field Identifier

1 Form of payment number 1

FORM OF PAYMENT AMOUNT

This is the amount to be refunded for a specific form of payment. To update the form of the payment amount, enter: TRFU/FPA11750.00

This is the amount to be refunded for a specific form of payment. To update the form of the payment amount, enter: TRFU/FPA11750.00

/FP Slash, Form of Payment field identifier

A Amount Identifier

1 Form of Payment Number 1

1750.00 Amount for a refund (QAR1750.00)

System Response:

System Response:

REMARKS

In this field, you can enter additional information related to the refund. To update this field, enter: TRFU/RMDUE TO NO OPERATION

In this field, you can enter additional information related to the refund. To update this field, enter: TRFU/RMDUE TO NO OPERATION

/RM Slash, Remarks field identifier

DUE TO......... Free Flow Text

ORIGINAL ISSUE

This field contains the original issue information when you are refunding an exchange document. To update this field, enter:

TRFU/FO1254810067610DOH15APR1077777722

ORIGINAL ISSUE

This field contains the original issue information when you are refunding an exchange document. To update this field, enter:

TRFU/FO1254810067610DOH15APR1077777722

/FO Slash, Original issue field identifier

1254810067610 Document Number

DOH Place of issue

15APR10 Date of issue

77777722 Document issued office IATA number

FULL REFUNDS

Following are the steps to process the full refund on Amadeus which is reported to the local BSP.

STEP1

Initiate a refund and display the refund record by using any one of the following options.

STEP 2

If any cancellation penalties enter: TRFU/CP100A

FULL REFUNDS

Following are the steps to process the full refund on Amadeus which is reported to the local BSP.

STEP1

Initiate a refund and display the refund record by using any one of the following options.

STEP 2

If any cancellation penalties enter: TRFU/CP100A

Where:

TRFU The transaction code to update refund record

/ Slash

CP Cancellation Fee Indicator

100 Amount in Local Currency (Qatari Riyals)

A Amount Indicator

NOTE: When you refund a document with a cancellation penalty and you do not specify amount indicator (A), the system considers the default to always be a percentage (P).

STEP 3

To process the refund, enter: TRFP

NOTE: When you refund a document with a cancellation penalty and you do not specify amount indicator (A), the system considers the default to always be a percentage (P).

STEP 3

To process the refund, enter: TRFP

System Response:

OK ETKT RECORD UPDATED SAC- 125SDXU4IWDWO

OK - REFUND PROCESS

The status of all refunded coupons in the e-ticket record is changed to 'R' (refunded) after which it can not be reversed to ‘’O’’ / ‘’A’’

In the PNR, the existing FA element for the refunded ticket is removed, stored in the PNR history, and replaced by a new FA element that includes the ER status code; this indicates that the ticket has been refunded.

For Example:

The status of all refunded coupons in the e-ticket record is changed to 'R' (refunded) after which it can not be reversed to ‘’O’’ / ‘’A’’

In the PNR, the existing FA element for the refunded ticket is removed, stored in the PNR history, and replaced by a new FA element that includes the ER status code; this indicates that the ticket has been refunded.

For Example:

Electronic Ticket Refund:

FA PAX 125-4810006632/ERBA/S2-3

Here: ER Status Code (Electronic Ticket Refunded)

You can ignore a refund record at any time prior to processing (TRFP) the record with the following entry: TRFIG

From the Query Report (TJQ) display, you can cancel a refund record (If Airline Support cancels function for refunds) that has already been processed by entering the following before the sales report reported to local BSP: TRDC/001537

FULL REFUND EXAMPLES

Following are the examples for a full refund:

PUBLISHED FARE FULL REFUND

For example, a ticket 125-4810067612 needs to be fully refunded with QAR100.00

Cancellation/Refund Penalty. The following steps will apply.

PNR

You can ignore a refund record at any time prior to processing (TRFP) the record with the following entry: TRFIG

From the Query Report (TJQ) display, you can cancel a refund record (If Airline Support cancels function for refunds) that has already been processed by entering the following before the sales report reported to local BSP: TRDC/001537

FULL REFUND EXAMPLES

Following are the examples for a full refund:

PUBLISHED FARE FULL REFUND

For example, a ticket 125-4810067612 needs to be fully refunded with QAR100.00

Cancellation/Refund Penalty. The following steps will apply.

PNR

QUERY REPORT

STEP1

Initiate a refund and display refund record by using any one option of the following options:

System Response

Initiate a refund and display refund record by using any one option of the following options:

System Response

STEP2

Update the Cancellation/Refund Penalty, enter: TRFU/CP100A

Update the Cancellation/Refund Penalty, enter: TRFU/CP100A

STEP 3

To process the Automated Refund: TRFP

To process the Automated Refund: TRFP

System Response

STEP 4

To display the e-ticket record, enter: TWD/TKT125-4810067612

To display the e-ticket record, enter: TWD/TKT125-4810067612

STEP 5

To display the Query report for refunded documents, enter: TJQ/SOF/QTC-RFND

To display the Query report for refunded documents, enter: TJQ/SOF/QTC-RFND

System Response

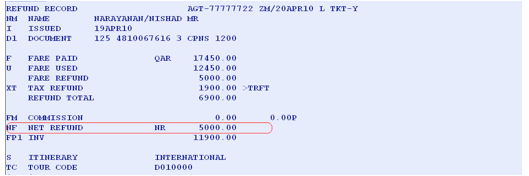

NET FARE FULL REFUND

Following are the steps for Net Fare full refund.For example, an e-ticket 1254810067615 was issued for Published Fare

QAR17450 and Net / Market Fare QAR10000.00 with taxes QAR1900.00

STEP 1

Initiate a refund and display refund record by using any one option of the following options:

System Response:

Initiate a refund and display refund record by using any one option of the following options:

System Response:

STEP 2

As per the Fare rule, QAR410.00 Penalty will apply before departure:

As per the Fare rule, QAR410.00 Penalty will apply before departure:

STEP 3

Update the cancellation penalty amount, enter: TRFU/CP410A

Update the cancellation penalty amount, enter: TRFU/CP410A

System Response:

STEP 4

To process the refund, enter: TRFP

To process the refund, enter: TRFP

System Response:

STEP 5

To display the Query report for refunded documents, enter: TJQ/SOF/QTC-RFND

To display the Query report for refunded documents, enter: TJQ/SOF/QTC-RFND

System Response

System Response:

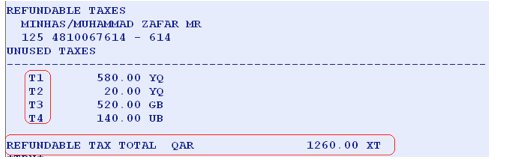

PARTIAL REFUNDS

We use the partial refund option to refund some unused coupons of the documents. When a partial refund is required the data can be changed by using TRFU transaction.PARTIAL REFUNDS EXAMPLES

Following are the examples for the partial refunds

PUBLISHED FARE PARTIAL REFUND

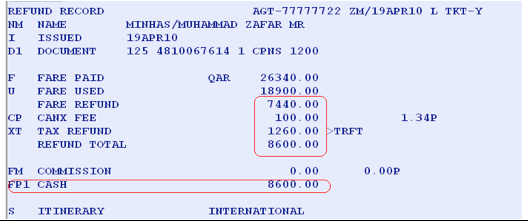

For example, an e-ticket 1254810067614 was issued for Fare QAR26340 and taxes QAR1900.00

Issued E-ticket Record:

Following are the examples for the partial refunds

PUBLISHED FARE PARTIAL REFUND

For example, an e-ticket 1254810067614 was issued for Fare QAR26340 and taxes QAR1900.00

Issued E-ticket Record:

Travel Agent needs to be partial/Half refund with Fare QAR7440.00, Taxes QAR1260 and refund charges QAR100.00. The following steps will apply:

STEP1

Initiate a refund and display a refund record by using any one of the following options.

System Response:

STEP1

Initiate a refund and display a refund record by using any one of the following options.

System Response:

STEP 2

Update the utilized fare for used coupons, enter: TRFU/U18900

Update the utilized fare for used coupons, enter: TRFU/U18900

System Response:

STEP 3

If any Cancellation/refund Penalties enter: TRFU/CP100A

If any Cancellation/refund Penalties enter: TRFU/CP100A

System Response:

STEP 4

To display Tax record, enter: TRFT

To display Tax record, enter: TRFT

The utilized taxes are: QAR 580.00 YQ (T1), QAR 20.00 YQ (T2), and QAR40.00 QA (T3).

Refundable taxes are: QAR 580.00 YQ, QAR 20.00 YQ, QAR520.00 GB, and QAR140.00 UB

STEP 5

To update refundable tax, enter:

Refundable taxes are: QAR 580.00 YQ, QAR 20.00 YQ, QAR520.00 GB, and QAR140.00 UB

STEP 5

To update refundable tax, enter:

STEP 6

The fully utilized tax QAR40.00 QA (T3) and needs to be deleted, enter:

TRFU/TX3

System Response:

The fully utilized tax QAR40.00 QA (T3) and needs to be deleted, enter:

TRFU/TX3

System Response:

STEP 7

To display the active refund record panel, enter: TRF

To display the active refund record panel, enter: TRF

System Response:

STEP 8

To process Auto refund: TRFP

To process Auto refund: TRFP

System Response:

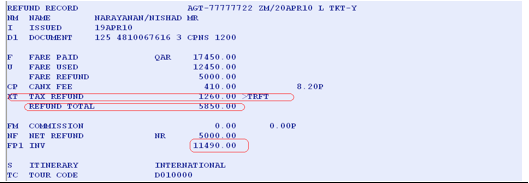

NET FARE PARTIAL/HALF REFUNDS

Following are the steps for Net Fare Partial/Half full refund.For example, an e-ticket 1254810067616 was issued for Published Fare

QAR17450 and Net / Market Fare QAR10000.00 with taxes QAR1900.00

Issued e-ticket Record:

Travel agent needs to be partially refunded with Net Fare QAR5000.00, Taxes

QAR640.00 and Penalty QAR410.00. The following are the steps will apply:

STEP1

Initiate a refund and display a refund record by using any one of the following options.

System Response:

Travel agent needs to be partially refunded with Net Fare QAR5000.00, Taxes

QAR640.00 and Penalty QAR410.00. The following are the steps will apply:

STEP1

Initiate a refund and display a refund record by using any one of the following options.

System Response:

USED FARE CALCULATION

The following formula will apply to calculate the used fare:

{FARE PAID (Published) – FARE REFUNDABLE (Net Fare) = FARE USED}

Here:

FARE PAID QAR17450.00

The following formula will apply to calculate the used fare:

{FARE PAID (Published) – FARE REFUNDABLE (Net Fare) = FARE USED}

Here:

FARE PAID QAR17450.00

REFUNDABLE NET FARE QAR5000.00

Used Fare {17450.00 – 5000.00 = 12450.00}

STEP 2

Update the Used Fare, enter: TRFU /U12450

Used Fare {17450.00 – 5000.00 = 12450.00}

STEP 2

Update the Used Fare, enter: TRFU /U12450

System Response:

STEP 3

Update the refundable NET FARE Amount (QAR5000.00), enter: TRFU/NF5000

Update the refundable NET FARE Amount (QAR5000.00), enter: TRFU/NF5000

STEP 4

Update cancellation/Refund penalty (If Any), enter: TRFU/CP410A

Update cancellation/Refund penalty (If Any), enter: TRFU/CP410A

System Response:

STEP 5

Display the TAX panel, enter: TRFT

Display the TAX panel, enter: TRFT

System Response:

The utilized taxes are as: QAR 580.00 YQ (T1), QAR 20.00 YQ (T2) and QAR40.00 QA (T3)

Refundable taxes are as: QAR 580.00 YQ, QAR 20.00 YQ, QAR520.00 GB and QAR140.00 UB

STEP 6

To update refundable tax, enter:

TRFU/TU1-580 (T1)

TRFU/TU2-20 (T2)

TRFU/TU2-20 (T2)

STEP 7

The fully utilized tax QAR40.00 QA (T3) and needs to be deleted, enter:

TRFU/TX3

System Response:

The fully utilized tax QAR40.00 QA (T3) and needs to be deleted, enter:

TRFU/TX3

System Response:

STEP 8

To display the active refund record panel, enter: TRF

To display the active refund record panel, enter: TRF

System Response:

STEP 9

Update Refundable total Amount in the Form of Payment, where QAR5850.00 is the net refundable total amount, enter: TRFU/FPA15850

System Response:

Update Refundable total Amount in the Form of Payment, where QAR5850.00 is the net refundable total amount, enter: TRFU/FPA15850

System Response:

STEP 10

To process Auto refund: TRFP

To process Auto refund: TRFP

System response:

System Response: